Incubators are essential to the development of many innovative ventures, but it’s in the stage between venture and company where many going concerns stop going. That’s when they don’t know exactly how much space or how many people they will need, and how fast the operation can grow. If they lock into a spot, they can end up choking on the lack of space or drowning in more space than they need or can ultimately afford. This is especially true of research labs.

That’s why some organizations are building large facilities with flexible space that can expand with tenants while accommodating their lab needs. Momentum Labs, a division of Concept Companies, fills in the missing middle, says Kyla Frye, Concept Companies director of science and technology ecosystems.

“A lot of the companies that you’re familiar with in incubators are startups,” says Frye. “They’re just getting their funding and figuring out their employees, processes, and how to grow their business. But a lot of them are not quite ready to leave the comfort and support of the incubator, which creates a problem for incubators, because they’re at full capacity, yet they have a waiting list. That is where Momentum Labs comes in. As a second-stage biotech hub, we’re able to offer them the flexible growth lab facilities with the resources they are accustomed to.”

As an in-between facility, Momentum Labs has the shared equipment and business resources found in incubators, but with more room to grow, as entrepreneurs learn how to turn their venture into a sustainable business. These tenants tend to have grown from small ventures of 10 to 20 employees to larger operations with 50 to 150 people.

Besides the space, Momentum Labs offers business resources, access to capital, and a nationwide network of partners and advisors. The vision and support of Momentum Labs come from Concept Companies, a full-service real estate development company. Since 2014, the company has pushed into the life science and technology fields with research and development, process development, and GMP manufacturing facilities.

Momentum Labs’ Alachua, Fla., operation is a 56,000-sf flexible facility focused on amenities to accommodate growth-stage biotech companies which have few options to spread out in full-capacity incubator spaces.

“This is a huge issue from Boston to Research Triangle Park to Florida to San Diego,” says Frye.

The facility is designed to accommodate a variety of life sciences companies, many of which want BSL-2 lab spaces, cell culture rooms, and collaborative spaces to meet with their teams. The building is split about 70/30 labs/amenities.

“We wanted to make sure that we had plenty of huddle space, conference rooms, collaborative spaces, and shared shipping and receiving—all of the things that are critical to what they’re doing day in and day out,” says Frye, adding that they also created outdoor space to take advantage of Florida weather and accessibility to neighborhood amenities, such as a brewery and café across the street.

The building had to be built on spec, meaning just about everything needed to be flexible, a particular challenge with labs.

“We have one area of fixed casework that includes the sink. Everything else is movable,” says Frye, who adds that they did not know what companies would occupy the building. “We now have about 60 percent of our building pre-leased, and that required a lot of changes. But because we started off being so flexible in our design, we were able to accommodate for specialty programs.”

It is critical to think about air handling, generators, and deionized water when designing spec buildings for this sector, says Frye.

In putting the structure together, they placed shared core features toward the middle so they are accessible for most of the companies. The wide variety of lab spaces have pass-through doors, so a company can easily expand into the adjacent space if necessary. They also have pass-through windows from offices to labs that help keep an operation connected. Workstations in the middle can be converted to cell culture rooms.

Amenities include coworking space, kitchenette, and access to the patio. Water, storage, and shipping and receiving are located at the back of the facility.

USF Focuses on Flex Space in New Facility

The University of South Florida Research Foundation, a private 501(c)(3) that provides resources and facilities for research and technology transfer, has been at the forefront of providing research facilities for decades. But even with about 400,000 sf of space, the park remained nearly 100 percent occupied for a decade and could not accommodate the many tech companies moving to the Tampa area, says Allison Madden, chief operating officer for the foundation.

“Our incubator program is a significant presence in the USF Research Park,” says Madden, adding that it uses up to 60,000 sf. “There is a three-year waiting list for their wet lab facilities, and a pretty substantial waiting list for their office space. An expansion within the newest core-and-shell building in the Research Park is imminent.”

The core and shell of the $42 million, 120,000-sf facility was recently completed. Like the Momentum Labs building, flexibility was key for the new three-story structure. Although it anticipates a 60/40 lab/office configuration, flex is necessary because the foundation knows that the need for lab space is ravenous.

“Our park has a 140,000-sf building that was originally programmed 50/50,” says Madden. “At this point, it is 80 percent lab space and 20 percent office. Another building within the park was intended to be 100 percent office space, and that is now 45 percent lab space, with more projects to renovate office space to lab use. While our 400,000 sf has been 100 percent occupied for a decade, we were still churning that space. We were turning that from office space into newer and better lab space.”

The incubator expansion within the newest building has a core of shared facilities that supports private labs branching off that central stem. Four private labs are intended for chemistry and six are bio-focused.

Among the many challenges in the project was making certain the facility remained flexible, even if that meant redirecting their own architects.

“With a need to provide a temporary landing space for those joining our community, a suite originally designated for chemical storage was built into five lab work modules,” says Madden. “The idea is that you enter from the corridor into a desk space that can serve at least two people at the same time. Then you move through glass doors into the laboratory spaces with casework (both fixed and movable), a fume hood, DI (deionized) water, and easy access to a freezer farm with autoclave, glass wash, and other shared resources.”

That allows the facility to accommodate new tenants while their space is being constructed.

“The expectation is that it’s not perfect,” says Madden. “It’s probably not going to be exactly what you need long term. But it’s a place where you can arrive, plug in, and get to work while the bespoke lab is designed and constructed.”

The community also recognized the need for amenity spaces such as a café and a rooftop deck that provide the interactions that lead to collaboration.

Planning is Key, and IoT Data Can Help

An important balance in constructing second-stage facilities is between providing enough infrastructure to support a variety of labs while keeping the responsibility of the fit-out with the tenant, says Tyler Dykes, a mechanical engineer and science and technology market leader with Affiliated Engineers Inc. That takes a bit of forecasting into what tenants will require, not just for their needs but also to work around existing tenants.

“The first thing we think about graduate incubators, obviously, is we want the space to be adaptable,” says Dykes, “but we also want to minimize the disruption to other areas of the building or to other operational labs when a tenant comes in and needs something different, or something a little more specialized.”

Specialized can mean compressed air, water loop extending, or simply upsizing. For example, without proper planning, if a tenant needs a vacuum pump that requires more power, that could mean going down the corridor, taking ceilings down for power, piping, and ductwork, disrupting everybody else’s space along the way.

“So, the key in this type of application or this type of environment is planning those connection points,” says Dykes, “and working with the owners and the user groups to figure out what the renovations in the future are going to be linking to.”

The aim is to drive down the “day one” cost by limiting the shell-and-core cost and deferring as much as reasonable to the tenant fit-outs, says Dykes. The next step is being able to pivot—speed to market is critical.

“We have to be able to turn around and design pretty quickly,” says Dykes. “A key part of that is having the background in lab design and being able to work with good lab planners that are able to categorize spaces and know what goes along with each type of space.”

Without that planning, even with a new structure, owners might find themselves trying to shoehorn lab clients into what is essentially office space.

“The key to this is not having to figure this out on the fly,” says Dykes. “And that’s what allows us to do it quickly and deliver the speed in response to what these types of clients need.”

A couple of trends are also helping optimize space and reduce the square footage that companies need.

First is the growth of the Internet of Things (IoT), which provides real-time data on how buildings are being used, especially because of electronic controls. Not only does it indicate how much space is actually needed, it also helps occupants get by on less space.

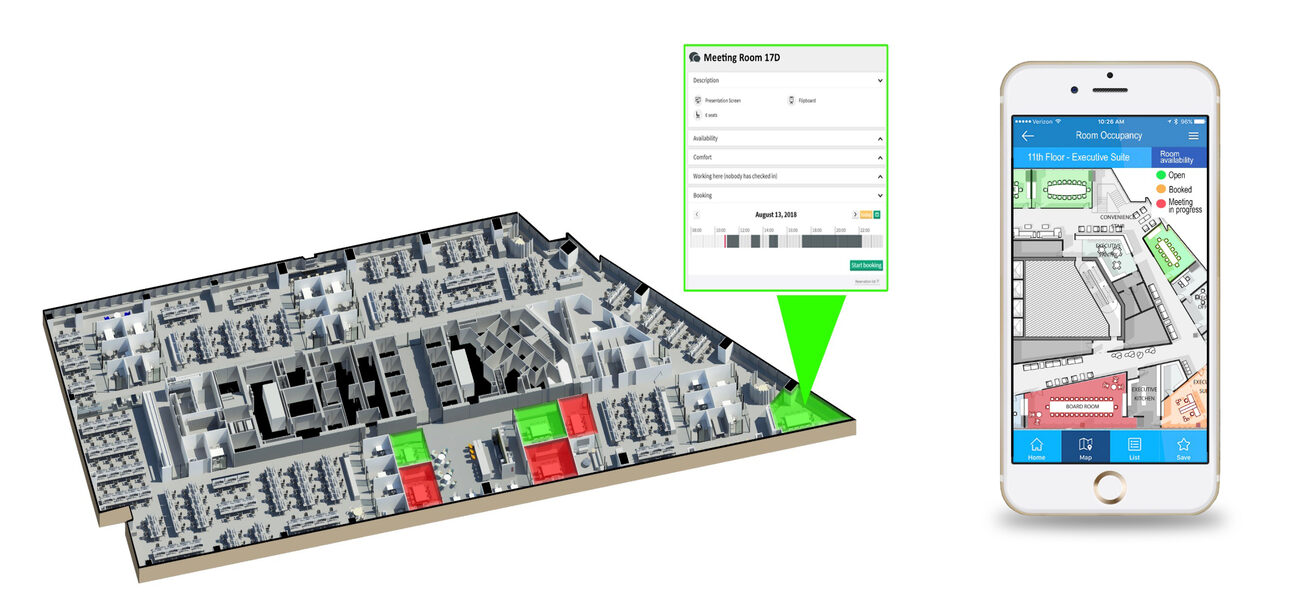

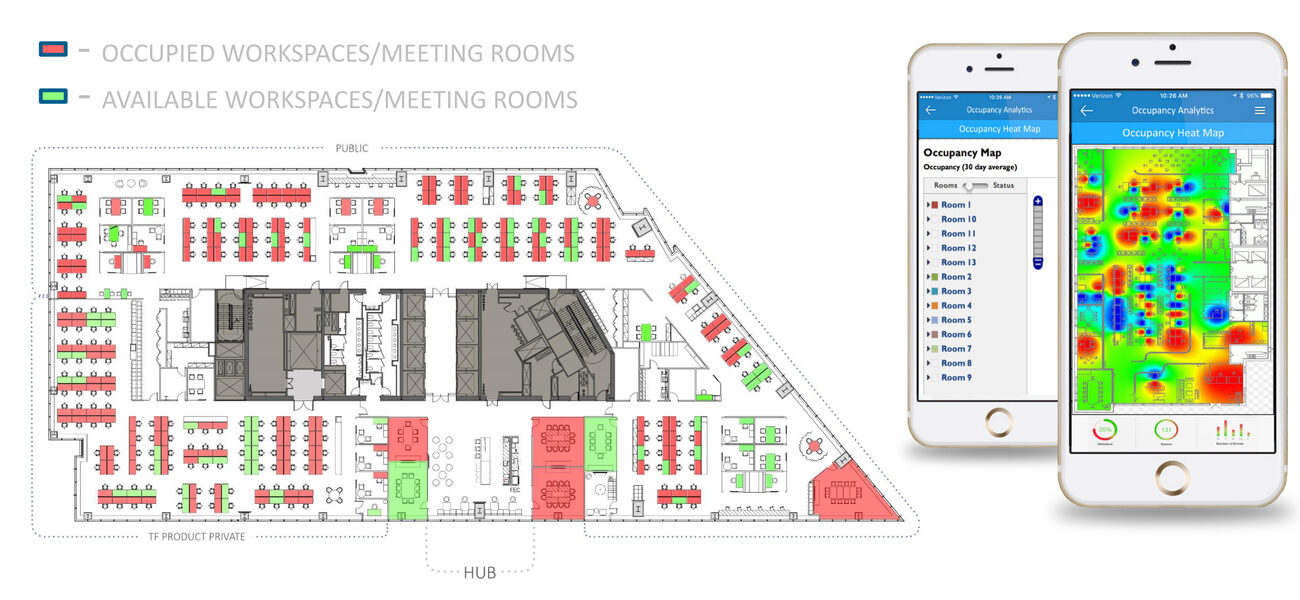

Dykes’ own office uses a system that electronically controls work stations that are not assigned to a particular person.

“We have more people than we have desks, and we have less conference space than we’ve ever had,” says Dykes. “If I’m going to work in the office for a day, I need to check out an office. It is done from a smartphone. It also provides heat mapping. The idea is that if I need a quiet space to go and study or go have a phone call, I can pull my app up and figure out what areas of the building and what collaborative spaces are less occupied than others. I can use this to find people in the building, find collaborators in the building that I want to catch up with.”

Besides helping manage the space efficiently, the technology can reduce the space a company needs. Dykes cited a real estate company that used similar strategies, including heat-mapping, for hoteling and hot desking, another workspace trend.

“This particular client was in the market for 1.8 million sf of office space. What came available and was attractive to them was 1.1 million sf of office space, 70 percent of what they needed,” says Dykes. “They figured out how to make it work based on this kind of strategy of not having a desk for every person. By using hoteling and hot desking, they were able to cut their space needs by 30 percent. That is as a result of having this kind of data.”

By Steven A. Morelli